Industry White Paper

Jan 1, 2021

John H. Powell & Mark S. Giroux

Copyright John H Powell Consulting LLC

John H Powell Consulting (JHPC) offers a wide range of consulting services to people and organizations within or considering participating in the vending industry. The JHPC team collectively brings in over 50 years of hands on experience at the intersection of technology and business in route vending operations, micropayments, and unattended POS transactions.

The principals at John H Powell Consulting have prepared a comprehensive white paper on the automated unattended point of sale industry commonly known as vending. This complex and unique industry is comprised of a wide and diverse range of stakeholders. The purpose of this White Paper is to provide a framework of understanding for those considering entering this industry as operators, those seeking to expand their operations, or those interacting as other stakeholders. It also explains the forces that are creating the current challenges and the growth opportunities within traditional vending (packaged food and beverages) and the creative spin-offs that are emerging in non-traditional vending thus opening a universe of opportunities.

The menu below provides online access to the introduction to the white paper and the section summaries for each chapter. You may request a copy of the entire white paper free of charge by clicking on the link below.

Contents:

Introduction

Industry Overview: Traditional Vending is run by route Operators who deliver food and beverage products to their customers. This industry has suffered with the decline of large traditional manufacturing facilities and the corresponding loss of lucrative employee breakroom locations. This problem has been compounded as society shifts towards healthier choices and away from the high calorie, high salt products traditionally found in vending machines. The industry is reeling from a decades-long decline in the industry.

During this time, a core group of successful operators and their value-add stakeholders began to adapt to this new industry paradigm, redefining themselves as value-added delivery service providers. Their proactive actions included shifts in emphasis to Micro Markets, Coffee Service, Pantry Service and the implementation of more efficient processes, procedures, and back end technologies. Increased activity in bulk product delivery helped increase volume, increasing their economies to scale. Forward-thinking organizations were able to prosper while their competitors continued to decline. This set the stage for a significant consolidation that continued through the end of 2019.

Covid hit the country with a vengeance in the first quarter of 2020. Vending like most service sector industries saw a catastrophic drop in business. Operators saw declines ranging from 60% to 90% in sales volume. Markets and vending machine sales dropped precipitously as manufacturing locations shut down or went to skeleton operations. School closures and the temporary suspension of convention, theme park and sporting events took an enormous toll as well. The economic effects of Covid were amplified by the severe drop-in Office Coffee Service (OCS) and pantry services business. Sales in these areas were even greater than those at machines and markets. Even bulk sales business was impacted as small convenience stores and restaurant customers closed or scaled back.

The following provide some pre-Covid benchmark metrics*

- Machine placements 3 to 4 million

- Market placements less than 150,000

- Office Coffee Service offered by over half of all operators

- Annual revenues $15 to $20 Billion

- Annual transactions 7 to 9 Billion

- Total operators about 5,000

- Average reported operator margin is below 3%

- Excellent operator margin can exceed 25%

- 80% of sales are done by 20% of the operators

The post shutdown and longer-term outlook will be covered in the trends section of this paper.

*Important note: Exact numbers have never been available for the Vending Industry. This is due to several factors including but not limited to the following: Many small to medium sized vending operators do not belong to the national association. Vending has traditionally been a cash business where actual revenues are often underreported. Fierce competition discourages information sharing. Many of the more poorly run vending operations do not have accurate data. The numbers provided are based on personal knowledge, published industry figures and best estimates based on multiple discussions with industry insiders.

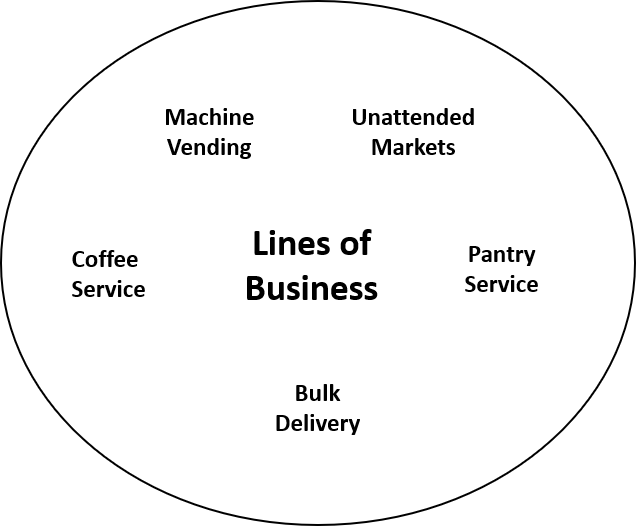

Lines of Business

There are many ways to categorize and sub-categorize the services that route operators offer their customers. Some of these could include types of products provided, types of retail customers, and/or types of locations. This paper sorts traditional vending operations into Lines of Business which focuses on how the vending service is provided. The result is an industry divided into 5 key lines of business: Machine Vending, Unattended Markets, Coffee Service, Pantry Service and Bulk Delivery.

The complete Lines of Business Section is contained in the Vending Industry White paper and is available at no charge upon request.

A classroom version of this topic is offered by JHPC in both virtual and on-site formats, titled “The Vending Ecosystem.” This class will describe the vending marketplace in detail and, for parties outside the industry, provide a good understanding of “what vending is all about.” It would be especially beneficial for organizations interested in the consolidation and also the reorganization of the vending industry from an operator or supplier standpoint. In addition, new or smaller operations wishing to take the next step in their growth would benefit from The Vending Ecosystem.

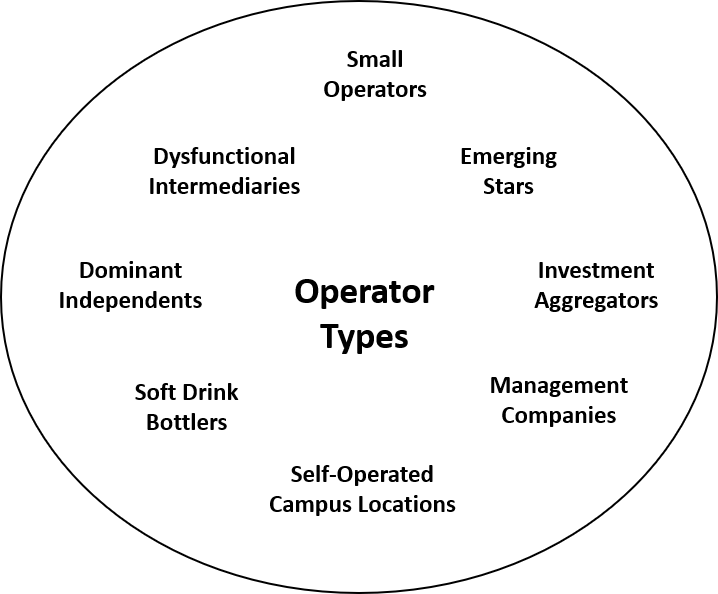

Operator Types

Having categorized lines of business it is now time to segment the operators. This section uses three criteria to group route operator companies. These are size, profitability and business ownership. Independently owned and operated route companies can be broken into four categories based on size and profitability. These are: Small Operators, Dysfunctional Intermediaries. Emerging Stars, and Dominant Independents. The remaining operators can be split into four groups based on ownership. These are Investment Aggregators, Soft Drink Bottlers, Management Companies, and Self-Service Locations.

The complete Operator Types Section is contained in the Vending Industry White paper and is available at no charge upon request.

Vending Industry Stakeholders

This section looks at the most important members of the vending industry ecosystem. Like many mature industries vending has a large and varied group of stakeholders. The most important of these fall into one of the following general categories: Route Operators, Product Suppliers, Equipment Suppliers, Payment Facilitators, VMS-ERP (Enterprise Vending Platforms) Suppliers, Retail Customers, Commercial Customers, Regulating Entities, Location Managers, Management Companies, or Operator’s Employees.

The complete Industry Stakeholders Section is contained in the Vending Industry White Paper and is available at no charge upon request.

A classroom version of this topic is offered by JHPC in both virtual and on-site formats, titled “Succeeding as a Supplier.” This class will describe the interrelated world of the external stakeholders and their relationships to the route operators. The course is designed to start with a general overview and then dive deep into one or more specific supplier products and/or services of interest to our client. As such it will provide and excellent foundation for organizations considering entering the industry as suppliers or for current suppliers looking to expand their offerings. Organizations interested in providing or expanding payment acceptance services could greatly benefit from the “Payment Acceptance” class, where the unique and complex aspects of vending payments are covered as a separate topic.

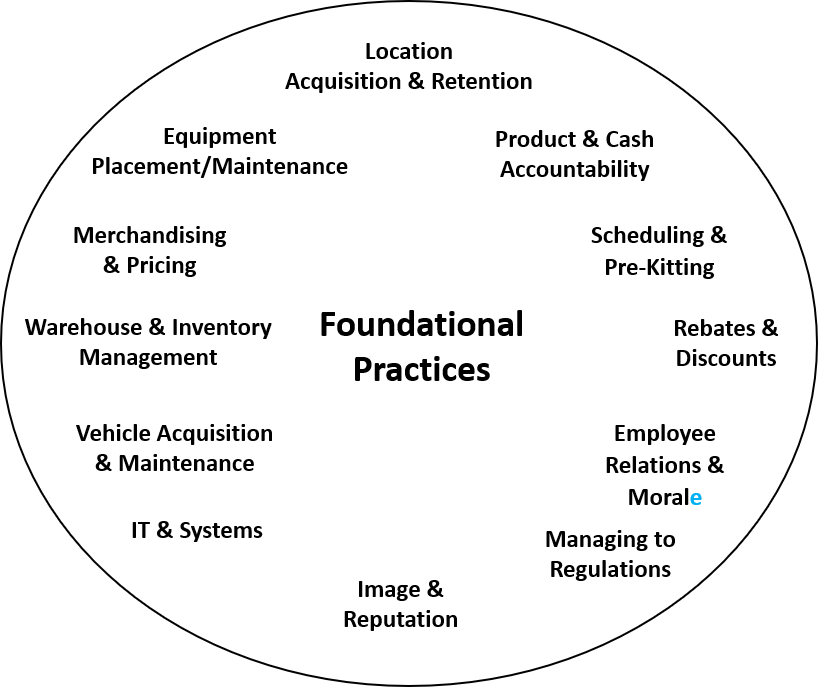

Foundational Practices

This section provides an overview of the tried and true practices that have historically differentiated good operators from poor ones. These have been the mainstay of the vending industry for the for the first half century of its existence. Today the industry is undergoing a rapid transformation. These practices are no longer the keys to being better than one’s peers: they are now the minimal essentials for a route operator’s survival. While this section if focused on the route operator company it should be foundational to anyone working in vending mergers, acquisitions, or financing. It also provides insight into the critical the features and benefits needed from today’s product, equipment, systems, and service providers.

The complete Foundational Practices Section is contained in the Vending Industry White Paper and is available at no charge upon request.

A classroom version of one particularly pertinent section of this topic is offered by JHPC in both virtual and on-site formats, titled “Payment Acceptance.” The most vital foundational practice is collecting payment for goods sold, and—especially with the changes accelerated by Covid-19—understanding and effective deployment and management of payment acceptance is critical. Contact us for more information on class offerings.

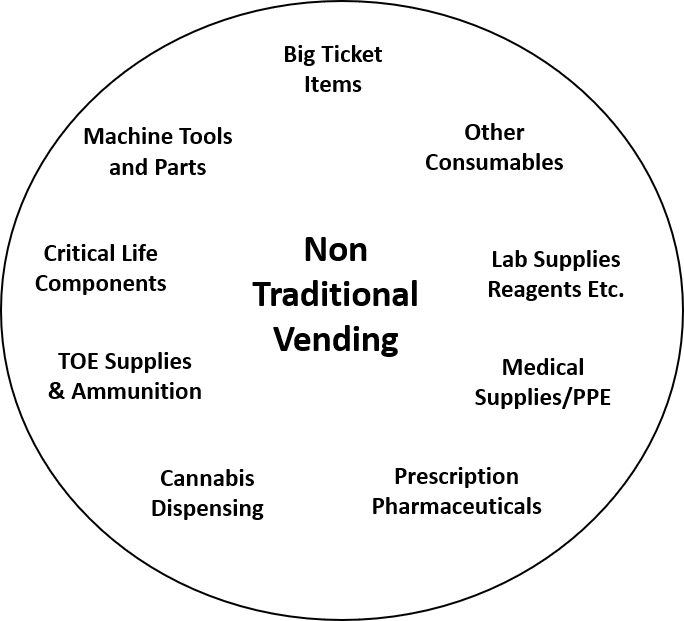

Non-Traditional Vending

Non-traditional vending is, for the most part, in its infancy with no real leaders to benchmark against but almost unlimited opportunities for those willing to think outside the established paradigms. The key will be to leverage next generation automation, communication, and payment technology to create value in a burgeoning world-wide virtual economy. This is the fertile ground for internet of everything applications. This section will examine examples of non-traditional opportunities. It will start with those that have not met expectations and end with some of the more exciting opportunities yet to be realized. The field is wide-open, and the future opportunities are limited only by the imagination of the dreamers and the skills, knowledge, and abilities of the doers to make it happen.

The complete Non-Traditional Vending Section is contained in the Vending Industry White Paper and is available at no charge upon request.

A classroom version of this topic is offered by JHPC in both virtual and on-site formats, titled “Non-Traditional Vending Opportunities.” This class will accelerate thinking outside the box and discuss a number of areas for profitable, sustainable growth outside traditional vending areas. Contact us for more information on this class.

Industry Trends

This section covers the key trends within the vending industry. These trends cover key industry trends during three specific time periods,

- Trends impacting the industry prior to the Covid Crisis

- Trends that resulted from the Covid crisis and the resulting lockdown

- Trends that are appearing as the economy reopens

These trends will be discussed for each section of this paper:

- Lines of business

- Operator types

- Stakeholders

- Foundational Practices

- Non-traditional vending opportunities

The complete Industry Trends Section is contained in the Vending Industry White Paper and is available at no charge upon request.

Growth Opportunities

The final section takes the material we have reviewed so far and summarizes it into four key opportunities for growth. These are Technology, Reinvention, Consolidation, and Reimaging.

The complete Growth Opportunities Section is contained in the Vending Industry White Paper and is available at no charge upon request.

John H Powell Consulting

John H Powell Consulting brings a unique set of skills and experiences to those seeking assistance with these opportunities. The JHPC team are change agents with a proven track record identifying, defining, developing, implementing, and commercializing new opportunities at the intersection of automated product dispensing and virtual transactions.

Our team has:

- Consulted for or partnering with each type of operator, management company, and aggregator as well as all the major soft drink bottlers

- Consulted for, worked for, or partnered with every major stakeholder within the vending and related payment acceptance industries

- Pioneered the development, implementation and commercial acceptance of traditional debit and credit card acceptance at vending machines (TNS Pepsi Project)

- Developed the first economical hardware package and system-wide-deployment program for a cashless payment system for the North American soft drink industry (Coinco Iris™)

- Played a key role in the early adoption of machine monitoring and management and its integration into VMS and cashless payments (Cantaloupe Seed)

- Enabled one of the key equipment suppliers to navigate the realm of swipe based cashless payment acceptance and break into contactless EMV chip cards for the Canadian market (Coinco InOne project)

- Led the team the designed, developed and implemented the first commercially available touchless vending and market solution (primary inventor Vagabond vīv)

- Also has a high level of skills and experienced with related industries to include

- Campus one card systems

- Vended Amusements

- Unattended laundry and car wash facilities